Exacta Order Management System Modules The Exacta order management system provides customers with a strong foundation for managing and tracking orders. By having the right product data at the right time, customers can easily track products and view detailed product reports. The 'classic' Mac OS is the original Macintosh operating system that was introduced in 1984 alongside the first Macintosh and remained in primary use on Macs until the introduction of Mac OS X in 2001. Apple released the original Macintosh on January 24, 1984; its early system software was partially based on the Lisa OS and the Xerox PARC Alto computer, which former Apple CEO Steve Jobs. Ordant is an advanced print estimating tool and order management solution, with an integrated Web-to-Print storefront. This online tool is designed to save you time by reducing the need for re-entry from one software to another, and as a result it will maximize the efficiency and profitability of your company.

Order Management System Software Mac Pro

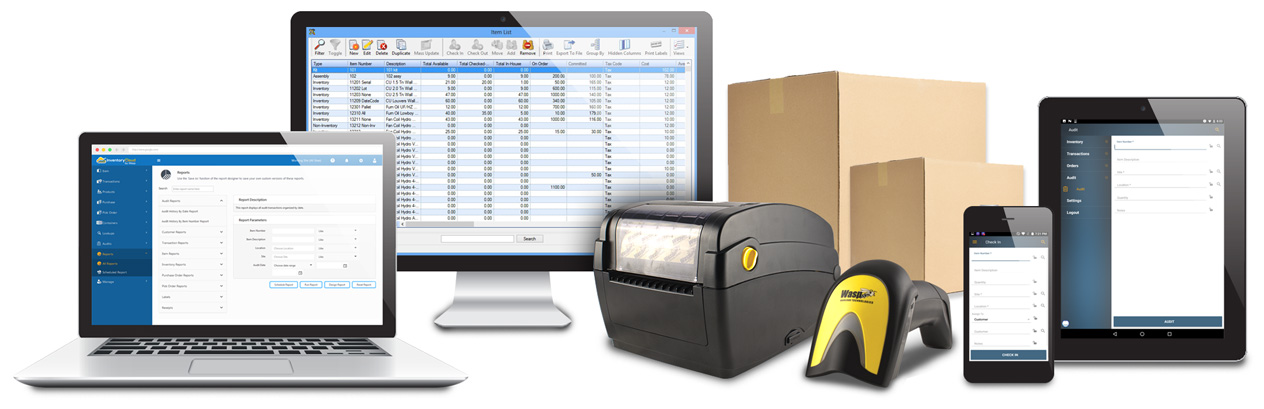

An order management system, or OMS, is a computer software system used in a number of industries for order entry and processing.

Electronic commerce and catalogers[edit]

Orders can be received from businesses, consumers, or a mix of both, depending on the products. Offers and pricing may be done via catalogs, websites, or [broadcast network] advertisements.

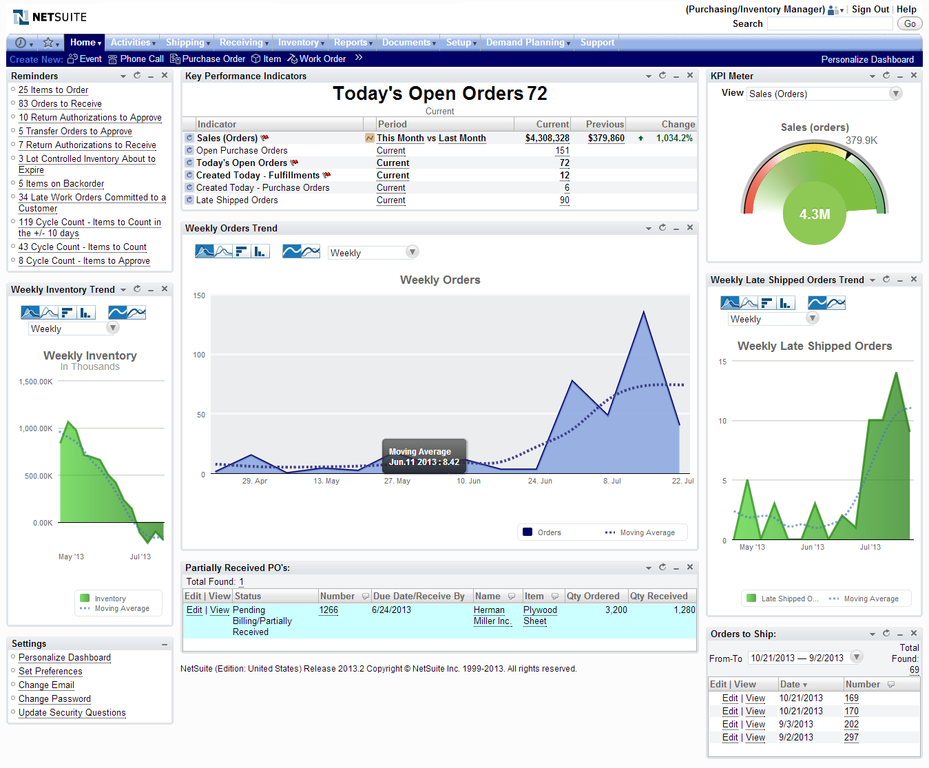

An integrated order management system may encompass these modules:

- Product information (descriptions, attributes, locations, quantities)

- Inventory available to promise (ATP) and sourcing

- Vendors, purchasing, and receiving

- Marketing (catalogs, promotions, pricing)

- Customers and prospects

- Order entry and customer service (including returns and refunds)

- Financial processing (credit cards, billing, payment on account)

- Order processing (selection, printing, picking, packing, shipping)

There are several business domains which use OMS for different purposes but the core reasons remain the same:

- Telecom[1] – To keep track of customers, accounts, credit verification, product delivery, billing, etc.

- Retail – Large retail companies use OMS to keep track of orders from customers, stock level maintenance, packaging and shipping and to synchronize orders across various channels such as e.g. if customer order online and pick up in stores

- Pharmaceuticals and healthcare

- Automotive – to keep track of parts sourced through OEMs

- Financial services

Order management requires multiple steps in a sequential process like capture, validation, fraud check, payment authorization, sourcing, backorder management, pick, pack, ship and associated customer communications. Order management systems usually have workflow capabilities to manage this process.[2]

Financial securities[edit]

Another use for Order Management Systems is as a software-based platform that facilitates and manages the order execution of securities, typically[citation needed] through the FIX protocol. Order Management Systems, sometimes known in the financial markets as Trade Order Management Systems, are used on both the buy-side and the sell-side, although the functionality provided by buy-side and sell-side OMS differs slightly. Typically only exchange members can connect directly to an exchange, which means that a sell-side OMS usually has exchange connectivity, whereas buy-side an OMS is concerned with connecting to sell-side firms.

Buy-side vs sell-side[edit]

An OMS allows firms to input orders to the system for routing to the pre-established destinations. They also allow firms to change, cancel and update orders. When an order is executed on the sell-side, the sell-side OMS must then update its state and send an execution report to the order's originating firm. An OMS should also allow firms to access information on orders entered into the system, including detail on all open orders and on previously completed orders. Sell-side OMS may offer direct market access and support for algorithmic trading. The development of multi-asset functionality is a pressing concern for firms developing OMS software.[3]

The Order Management System supports Portfolio Management by translating intended Asset Allocation actions into marketable orders for the buy-side. This typically falls into four categories:

- Re-balance – The periodic reallocation of a fund's asset allocation / market exposures to correct for market valuation fluctuations and cash flows

- Tracking – Periodic adjustment to align an Index Fund or SMA with its target

- Discretionary – Adhoc reallocation initiated by Portfolio Managers and Analysts

- Tactical Asset Allocation – Reallocation made to capture temporary inefficiencies TAA

How an OMS works[edit]

Mac System Software Download

Changes in positional allocation often affect multiple accounts creating hundreds or thousands of small orders, which are typically grouped into aggregate market orders and crossing orders to avoid the legitimate fear of front running. When reallocation involves contradictory operations, trade crossing can sometimes be done. Crossing orders involve moving shares and cash between internal accounts, and then potentially publishing the resulting 'trade' to the listing exchange. Aggregate orders, on the other hand, are traded together. The details of which accounts are participating in the market order are sometimes divulged with the trade (OTC trading) or post-execution (FIX and/or through the settlement process.)

In some circumstances, such as equities in the United States, an average price for the aggregate market order can be applied to all of the shares allocated to the individual accounts which participated in the aggregate market order. In other circumstances, such as Futures or Brazilian markets, each account must be allocated specific prices at which the market order is executed. Identifying the price that an account received from the aggregate market order is regulated and scrutinized post-trade process of trade allocation.

An additional wrinkle to the trade allocation process is that aggregate market order may not be fully satisfied. If, for example, a limit order is used to control slippage, then it may take weeks to fully implement a discretionary asset allocation change. This adds a participation fairness issue in trade allocation in addition to price fairness. The two aspects are compound since the market may move against your position under the pressure of your large pending aggregate market order (even if implemented as a dark-pool Program Trade.)

Some Order Management Systems go a step further in their trade allocation process by providing tax lot assignment. Because investment managers are graded on unrealized profit & loss, but the investor needs to pay capital gains on realized profit & loss; it is often beneficial for the investor that the exact share/contract uses in a closing trade be carefully chosen. For example, selling older shares rather than newly acquired shares may reduce the effective tax rate. This information does not need to be finalized until capital gains are to be paid or until taxes are to be filed, OMS tax lot assignments are considered usually tentative. The tax lot assignments remade or recorded within the Accounting System are considered definitive.

Compliance[edit]

An OMS is a>